The story for part two

After posting part one of the French regional banks analysis a couple of weeks back I finally had the time to finish writing part two. In part one I told the risk arbitrage story of the French regional banks. What I then concluded was, even though there existed a strong underlying catalyst, that story was highly unlikely to end with a happy ending in the short to medium time horizon. Wrapping up part one I also sat the stage for the story of part two for the French regional banks when I wrote:

Next time I will present the other side and when put together with the risk arbitrage side I think a basket of French regional banks make a perfect Dhandho investment – heads I win tails I don’t lose much. So stay tuned!

If you are short of time or don’t care to read this second part of my analysis, I will for a moment leave the stage over to monsieur François Badelon (fund manager at Amiral Gestion[1]) to tell a summarized version of the story for the French regional banks that I will focus on in this part:

After listening to François Badelon I think you have figured out what part two is all about and what story I’m going to tell. Yes that’s right, I’m going to tell a classical value investing story about the French regional banks. Because of the length of text that part two has amounted to I have decided to split it up into two posts. The second post to part two will be published next week.

The numbers

In order to tell a good value investing story I think we all can agree on that we have to start with the numbers. Below you will find a summary of what I find to be the most important numbers and ratios to look at for all thirteen regional banks. If you are interested in the excel-document and want to take a closer look just send me an email at cigarrfimpar@gmail.com and I’m glad to share this with you.

*Note that the share prices in the excel summary represent my entry share price as of 13/10-2016. Since then the share prices for all banks have moved up a bit. To view the current share prices and the return on the regional banks since I bought them I recommend you to follow this link to my portfolio.

Price and value

For me price and value are not only cornerstones to the way I approach value investing, they are the absolute heart and starting point of my investing philosophy. I want the discrepancy between the two factors to be so evident that it feels like I get punched in the face by Mike Tyson, i.e. deep value.

In the case of the regional banks I got punched big time when I started to look at the valuation multiples. The regional banks are selling at ridiculous low multiples, both in relation to book value (average for the thirteen banks: P/B = 0,31x) and earnings for the trailing twelve months (average for the thirteen banks: P/E-ttm = 5,4x). This is also true if we look at the average earnings for the last ten years (average for the thirteen banks: P/E10 = 1,4x).

Not only are the banks cheap on an absolute basis. In relation to what banks in general are selling for around the world I conclude that the French regional banks are ridiculously cheap. It might not be the fairest comparison but two European banks that should be selling at very low multiples are Royal Bank of Scotland Group (RBS) and Deutsche Bank AG (DBK). The current P/B-multiples for those banks as of current date are 0,4x and 0,5x respectively. Regarding P/E-ttm, a comparison shows that both RBS and DBK have a negative earnings number for the last twelve months, i.e. P/E = N/A. Finally, P/E10 for RBS is still N/A since the aggregate profit is negative for the last ten years, for DBK the P/E10 multiple is 15x. We can also compare the multiples in relation to Credit Agricole SA (ACA). If you remember from my part one analysis the regional banks together own 56,7 % of ACA and until very recently ACA in return owned 25 % of each regional bank. ACA is currently selling for P/B = 0,5x, P/E = 8,8x and P/E10 = 25,7x.[2]

When I have found something that I consider to be Mike-Tyson-punched-in-the-face-cheap I move on trying to map the explanation for the discrepancy. The reason behind this is that; when something is really cheap there is often a good explanation for it. As a deep value investor I’m quite used to owning stuff that no one wants or care about and where there also exists an explanation for why this is so. What I try to do is to take advantage of these situation. Not because I necessarily disagree with the explanation but because Mr Markets has an ability to estimate the probability and/or effect of that explanation in a very biased manner. This is commonly related to the notion of loss aversion and some other well-known biases. Going forward with this analysis I will start to dive into the different parts of the banks numbers and ratios with the intention to map out the underlying explanation for the very low valuation multiples.

Profitability

A typical deep value story often includes the words “negative” and “loss”. However, all thirteen French regional banks have been profitable on a net income level every single year for the last ten years (note that I haven’t checked further back in time). The same statement cannot be made for most banks in Europe (or the in world for that matter) and especially not for RBS and DBK. Taking into account the evolvement of the banking sector with increased capitol demands over the last ten years at the same time dealing with a difficult macro-economic environment in France, I find this achievement from the regional banks really impressive. On the negative however it should be noted that the annual growth rate for the top and bottom line of the regional banks is quite unimpressive (most regional banks range in between 0-2 % CAGR for the last ten years).

When it comes to evaluating bank profitability, not only looking at which banks have showed a stable earnings and growth record, two common metrics are used. Those are bank efficiency ratio (also known as cost-to-income-ratio) and return on equity (ROE). Let’s take a look at the regional banks profitability in relation to these ratios and how they compare to other banks.

Bank efficiency ratio

The bank efficiency ratio is a measures that shows how cost efficiency a bank is. It’s a good measure to use in order to get a grip of banks quality attributes. The measure takes the bank costs (personnel, administration, depreciation, and other costs) as a percentage of the banks net banking income. In short, a lower bank efficiency ratio is better than a higher one.

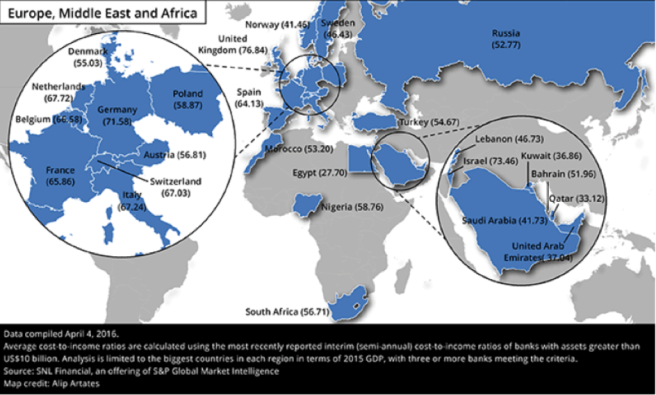

Before I present the French regional banks efficiency ratios I would like to set the stage for what level of bank efficiency is to be viewed as good vs. bad. In an article published in April 2016 the bank efficiency ratio of banks worldwide was presented[3]. This might not be the fairest comparison as the ratio will naturally vary between countries, legislation and the type of banking that the bank provides. Also, the article is focused on large banks, such as ACA, DBK and RBK, not regional banks that have a focus on retail banking. Nevertheless, here is an overview:

The same article also presents the ratio for specific banks. Below I have included the table for some European banks, including the ones that earlier have been mentioned in this analysis (RBK, DBK and ACA):

Now to the French regional banks. In the picture below I have presented the efficiency ratios for each regional bank. The ratio is presented both for the 2016 half year report and for the 2015 full fiscal year.

As can be observed above, the efficiency ratio for most regional banks are really good in comparison with the largest European banks. Moreover, in relation to the bank efficiency map, where the average bank efficiency ratio for France is stated to be 65,86 %, all regional banks come out on top. The same statement is also true in comparison to the average for many other European countries presented in the article. This final line of argument can also be validated via data from the The European banking authority (EBA). The EBA has a “risk dashboard” that is regularly updated (the latest update is for Q2 2016 figures[4]). The cost to income ratio for 156 European banks is divided into three buckets (green being the best and red being the worst).

As can be observed by the latest figures, 63,8 % of the 156 banks are placed in the worst bucket with a cost to income ratio of > 60 %. Going back to the table above for the thirteen regional banks, all of them except EPA:CRAP (freaky coincidence with the ticker name!?) are placed in the yellow bucket. Note that only 26,1 % of the 156 banks can be found in the yellow bucket and 10,1 % in the green bucket. To summarize and conclude, I find profitability achievement for the regional banks from a bank efficiency ratio perspective to be quite impressive and satisfactory both on an absolute and relative scale.

Return on equity

Moving on to the other profitability measure, return on equity (ROE). When we look at this metric it is important to note that it varies quite a lot between industries. Banks is one of the industries where the metric usually is low on an absolute scale, often in the low single digit range.[5] This statement is validated from the EBA “risk dashboard” regarding the 156 European banks ROE over the period Q4 2014 – Q2 2016. For all quarters the green bucket (banks that achieve a double digit ROE) has continuously included the fewest number of banks.[6]

In the picture below I have presented the ROE for the trailing twelve month and 5-year average for each regional bank.

Of the thirteen regional banks, based on ROE-ttm, six of those are placed in the red bucket (< 6 %). The rest are placed in the yellow bucket (6-10%). If we take a look at the 5-year ROE the number of regional banks that are placed in the red bucket is lowered to five. Taking into account that the majority of the French regional banks, both on a ttm (average for the thirteen regional banks = 5,9 %) and 5-year average basis (average for the thirteen regional banks = 6,1 %), are placed in the yellow bucket I again find the results quite impressive and satisfactory both on an absolute and relative level. Although, not to the same extent as was the case for the bank efficiency ratio.

Capital allocation

Banks are known for having a shareholder friendly attitude to their capitol allocation. Typically, they have a dividend rate above most other industries and, although not that common, some also have buyback programs. I haven’t found any good article or paper covering the buybacks from banks in Europe or in the world (if you know any please let me know). But what I have found is a good summary for dividend yields of banks in both the US and Europe. Again, this might not be the fairest comparison taking into account the size and nature of the banks included. Nevertheless, the average dividend yield for the twenty banks in Europe with the highest yield is currently 5,0 %[7]. In an article from march 2016 the 16 banks US banks included had an average dividend yield of 2,4 %[8]. The same article covering US banks also include the pay-out ratio for these banks. The average pay-out ratio for the same banks amounted to 29 %. With these figures in mind I would like to present the figures for the thirteen French regional banks:

All thirteen French regional banks pay a yearly dividend to the holders of the CCI-certificates (see part one analysis for explanation of CCI and the capital structure for the regional banks). They all have done so uninterrupted for the last ten years and for most years they have also increased the dividend paid (again I haven’t checked further back in time). On top of the yearly dividend, all regional banks also have a CCI buyback program. The buyback program allows the regional banks to own CCI’s in treasury (most banks are allowed to own 10 % of the total number of CCI’s), to provide liquidity to the market (sell CCI’s back to the market that the bank has owned in its treasury) and to “cancel” CCI’s from existing.

Both in absolute terms and in relation to the figures earlier presented for the European and US banks the French regional banks looks quite appetising from a shareholder’s capital allocation perspective. With an average dividend yield of 4,8 % the thirteen banks are just short of the average for the top twenty European banks (5,0%) and well above the US banks average (2,4%). The same statement is made even stronger if we take into account the net buyback yield of the regional banks. Far from all of the regional banks have a positive net buyback yield but most importantly none have a negative yield (i.e. CCI holders doesn’t get diluted). If we add the dividend yield together with the net buyback yield, we get the shareholder yield. For all thirteen regional banks the average shareholder yield is 5,7 %. Even if I don’t have any figures from other banks to compare the shareholder yield with, I’m quite confident that the regional banks would have been on the top of such a list. One final thought is that the current pay-out ratio for the French regional banks isn’t what you would consider distressed. In other words, the regional banks have good room for continued dividend growth. In comparison to the average pay-out ratio for the US banks of 29 % the 26,2 % average for the French regional banks is also to be considered as good.

Financial stability

The banks have been under quite a lot of pressure over the last couple of years, both from legislators and politicians, to strengthen their balance sheet and to lower their risk taking. This enforcement as you all know is related to the financial crisis’s that we have witnessed and the rise of an ever increasing complexity in the banking system. The enforcement has in practical terms resulted in a regulatory framework, known as the Basel international regulatory framework for banks. I won’t go into details about framework, but I can recommend a good video presentation of the framework for those of you that are interested[9]. Two important measures of the current Basel framework (Basel III) are the CET1 ratio and LCR ratio. So let’s take a look at the ratios for the French regional banks and how they compare against the regulatory framework but also against other banks.

CET1-ratio

The CET1-ratio (common equity tier 1 ratio) measures the equity in relation to the risk weighted assets of the bank. In other words, the ratio measures a banks long term survivability and solvency in times of financial distress. The riskier the assets the more weight it will carry in the calculation, naturally cash will have the risk weight of 0%. The Basel III framework requires banks to have a CET1-raitio > 7 %. In addition, national regulators can require the banks to have an additional 0-2,5 % of capital on top of the 7 %[10].

In the risk dashboard for Q2 2016 the average CET1 ratio for 156 EU bank’s amounted to 13,5 %.[11] Explained differently, 74,1 % of the 156 banks had a CET1 ratio in the range of 11-14 % (se picture below). Only 21,6 % of the banks had a CET1 ratio above 14 %. The picture doesn’t change much if we look at the French banking sector in specific. The average CET1 ratio for the French banking sector amounted to 12,8 % according to the ACPR report for 2015.[12]

With the above requirements and the average ratios for other European banks I mind the French regional banks look really solid if we now view their CET1 ratios:

With and average CET1 ratio of 20,3 % the French regional banks are not only placed in the green bucket but they also display a high margin of safety in relation to the Basel III requirements. One again again find the results quite impressive and satisfactory both on an absolute and relative level.

LCR-ratio

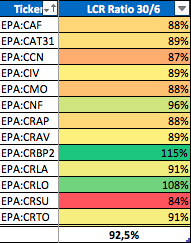

The LCR-ratio (Liquidity Coverage Ratio) is measure of the banks’ ability to cover outflows of cash (net liquidity outflow over 30 days) with its “high-quality liquid assets”. In other words, it measures a banks short term survivability and solvency in times of financial distress. Currently the Basel III framework requires a LCR-ratio > 70 %. However, the LCR-ratio is increased every year up until January 2019 when the ratio of full implementation is required to be above 100 % (LCR-ratio > 70 % (2016), 80 % (2017), 90% (2018), 100% (2019)).[13]

For some reason the EBA risk dashboard doesn’t include the LCR-ratio. However, the EBA publishes a Basel III monitoring report for European banks where the ratio is included. As of the 31 december 2015 the average LCR-ratio amounted to 133,7 % and 91 % of the banks of the 227 banks in the report had an LCR-ratio above the full implementation minimum requirement (> 100%).

If we now turn to the figures for the French regional banks they are obviously a bit behind the above figures with an average LCR-ratio of 92,5 %. As of 30/6-2016 only two of the thirteen regional banks had an LCR-ratio above the full implementation requirement of 100 % (EPA:CRBP2 and EPA:CRLO). Quite many of the banks have an LCR-ratio just below the 2018 requirement (> 90%). However, one bank (EPA:CRSU) have a LCR-ratio just above the 2017 requirement (> 80%).

To summarise and conclude, all thirteen regional banks have a good LCR-ratio for 2016 and 2017 but need further improvement in coming years in order to reach the minimum requirement of full implementation of 100 % as of 2019. In other words, I find the current LCR ratios for the French regional banks on absolute level quite satisfactory but on an relative level I’m not impressed.

The SACAM transaction

As was explained in detail in part one, the regional banks (all 38 regional banks in the Crédit Agricole Group not only the thirteen publicly traded), via a new company called SACAM Mutualisation, recently bought back the ~25 % ownership that ACA had in each regional bank. The negative side of this transaction was not only that minority shareholders were excluded but also that it had a negative impact on the regional banks earnings generation and CET1 ratio. The negative impact is mainly related to the cancelation of the Switch guarantee (a 5 B€ warranty under which the regional banks charged a 9.34% interest on 5 B€ deposited with ACA since the crisis of 2008). Because of the transaction the regional banks have presented some restated ratios and numbers that I have mentioned earlier in this analysis. In order to be to provide a fair view and anlysis I thought it be good idea to present those restated figures and ratios as well:

Although the restated P/E ratios and CET1 ratios are negatively affected by this transaction the effect is not that material that it changes my former conclusions regarding the ratios (i.e average P/T-ttm = 5,9x is still ridiculously cheap and CET1 = 17 % is still way above Basel III requirements and good in comparison to other banks).

As was presented in part one the French financial market regulator (Autorité des marchés financiers, AMF) has reviewed the SACAM transaction and come to the following conclusions (Google translated from the AMF- statement):

”Concerning the consequences of the transaction for the holders of CCIs, the AMF noted that the transaction will have no impact on (i) the liquidity of the CCIs, Sacam Mutualisation intending to hold long-term CCis acquired from Casa, (ii) the commitment made by the Regional Banks when listing Casa to distribute at least 30% of their result, this commitment being maintained by the said Caisses, and (iii) the remuneration of the CCIs, the Caisses Regional authorities have indicated that the remuneration for 2016 will be at least equal to that for 2015 and that their results should be increased by 2019.”

Casa = ACA

Caisses = regional banks

Similar statements have also been made by the regional banks themselves. Here is one in English from the regional bank Sud Rhone Alpes (CRSU).[14] In particular I find the first part of importance and interesting but the statement about the dividend policy and amount is of course soothing:

“The reclassification operation combined with the operating outlook for the Regional Banks therefore means that they can expect growth in aggregate net income under French accounting standards of around 10% by 2019.

Within this framework, the Crédit Agricole Regional Banks having issued CCI certificates confirm that they intend to maintain remuneration on these certificates in 2016 at least equal to that of 2015.

Furthermore, the commitment made by the Regional Banks upon the listing of Crédit Agricole S.A. to a payout rate of at least 30% will not be called into question, thereby guaranteeing the continuity of the payout policy for CCI and CCA certificates. ”

Finally, the SACAM company will allow the regional banks to strengthen their cohesion by pooling their results, “pay themselves” dividend instead of distributing this to ACA and take advantage of potential increase in value of themselves as good investments to a larger extent than before. To summarize and conclude, there is good and bad news with the SACAM transaction. Only time will tell if there is more or less of the other but as of current date I don’t see it to have a material negative effect on the regional banks.

Why me, God?

Based on my analysis of profitability, capital allocation, financial stability and the SACAM transaction it is hard to get clear understanding of why on earth these banks are selling for such ridiculously low valuation multiples. Nothing stands out as being the explenatory factor for the big discrepancy between price and value, both on an asset and earnings basis. When you find yourself in a situation like this I think it is a good idea to go back to Charlie Mungers famous saying:

“When you locate a bargain, you must ask, ‘Why me, God? Why am I the only one who could find this barging?’

In the second post of part two I will continue to paint my map of undervaluation. I will first try to answer the above questions by inverting it. I will also take a look at the current French banking and housing market and how/if that plays a role in the reason for undervaluation for the French regional banks. Finally I will wrap up the value investing story with the risk arbitrage story into a final map of undervaluation, i.e. my conclusion about the French regional banks as investment candidates.

Disclosure: The author is long all thirteen regional banks mentioned when this analysis is published.

As this will be my last post for 2016 I would like to thank you all for the feedback and comments I have received over the year. I means a lot to me that you take a part of your day to read my blog and interact with me. I wish you all a happy new year!

[1] http://www.amiralgestion.com/?sextants=sextant-autour-du-monde

[2] Valuation multiples for RBS, DBK and ACA are based on data from screener.co

[3]https://www.snl.com/web/client?auth=inherit#news/article?id=35864188&KeyProductLinkType=0&cdid=A-35864188-10284

[4] https://www.eba.europa.eu/documents/10180/1601217/EBA+Dashboard+-+Q2+2016.pdf

[5] https://hbr.org/2016/04/a-refresher-on-return-on-assets-and-return-on-equity

[6] https://www.eba.europa.eu/documents/10180/1601217/EBA+Dashboard+-+Q2+2016.pdf

[7] http://eqibeat.com/top-20-european-banks-dividend-yield-no-2/

[8] http://www.fool.com/investing/general/2016/03/29/big-bank-stocks-ranked-by-dividend-yield.aspx

[9] https://vimeo.com/59895335

[10] https://en.wikipedia.org/wiki/Basel_III

[11] https://www.eba.europa.eu/documents/10180/1601217/EBA+Dashboard+-+Q2+2016.pdf

[12] https://acpr.banque-france.fr/fileadmin/user_upload/acp/publications/rapports-annuels/20163011_ACPR_figures_report_2015.pdf

[13] http://www.bis.org/bcbs/publ/d299.pdf

[14] https://www.ca-sudrhonealpes.fr/Vitrine/ObjCommun/Fic/SudRhoneAlpes/CR/communiques/2016/UK_06-04-16_press-release.pdf

Great article! I will look into the regional banks too.

In the U.S. you have some activist (Seidman, Stilwell,..) forcing small banks to sell themselves. Do you know of any activist in Europe focusing on small banks?

LikeLike

Thanks for those kind words!

I don’t know of any activist investors that focuses on European small banks in the same way as in the U.S. Also, for the French regional banks the activists game is very hard to play. Because the publicly traded shares are “non-voting rights” (i.e. CCI’s, see part one for a more detailed explanation) the activists are missing the real tools of activism. However, there are a number of interesting value investors that are invested in the French regional banks (I will reveal more on this in the second post of part two). They along with many other minority shareholders are angry about the SACAM transaction and are currently in a legal process against the regional banks (again see part one for a more detailed explanation).

LikeLike

Thank you for the post. Very interesting and in-depth analysis.

I am a shareholder of another French bank, CIC. This is not a mutual bank and it is much bigger 6b capitalisation with a nationwide network.

Its valuation by the market is also crazy cheap 5 P/E and under 0.5 P/B.

Compared with similar banks, say bankia from Spain, its price should be double what it is.

The only reason I can see for its valuation is that it only has a 1% float with 99% owned by credit mutuel, a big mutual French bank.

Its capitalisation ratios are not as high as the regional banks. 11.7% cet1 under Basel 3 but it is more than adequate for its business.

It has grown the loans to customers in the last couple of years high single digits and if interest rates go higher in Europe in the medium term I think it could earn substantially more.

There are no catalysts for the price to go higher. Credit mutuel could try to buy out minority shareholders at a premium, it would cost them very little and would save listing fees but if they haven’t done it in all this year’s I don’t see why they would do it now

The most likely catalyst would be a shift in sentiment towards European banks, France and the European stock market. In 2006 and 2007 the share went as high as 350 (173 now) with similar profits and much lower book value

LikeLike

Thanks for your comment and feedback Jmp!

I have come across CIC doing my research for the regional banks I but didn’t go into any depth. From the information you have given me the bank seems quite interesting! CC also has been profitable for last ten years which I like. Thanks for the tip and I make sure to look into it!

There are a number of banks in Europe that looks appetizing and I think a basket of them will be a quite good investment over the years to come. As you point out, most make similar profits as before, have a much stronger balance sheet than before (because of Basel requirements) and still they are trading at very low P/B-multiples. If you don’t predict a catastrophic macroeconomic future and the end of the banking sector I think this is an interesting opportunity. However, it might take a while for the sentiment shift to take place but for most banks you get a good yield while waiting 🙂

LikeLike